John J. Hardy, FX Consultant, Saxo Bank

FX Closing Note: End of Month/Quarter/JPY Year - here we come!

Today is the setup day ahead of the end of the quarter for most of the world and the end of the financial year for Japan tomorrow. This month has seem some very chunky moves across asset classes, particularly in equities, and this, combined with end of month/quarter/year considerations tomorrow means that we could see extra large fixing volatility tomorrow.

If we throw the above comments together with the busy US calendar for the rest of the week and the Easter holiday on Friday (and Monday for much Europe) and we have the potential makings of a rather chaotic few days here.

The action today saw a renewed Euro sell-off on the continued Greek woes. The pound saw a resurgence on (rather flimsy) data support, and more likely on pressures in market positioning and a squeeze on shorts.

Chart: EURGBP

Today saw a huge sell-off in EURGBP that challenged important recent range support. The next big downside objective if the single currency is to gain further momentum is the 200-day MA average that has been so pivotal in the recent past.

Today saw a huge sell-off in EURGBP that challenged important recent range support. The next big downside objective if the single currency is to gain further momentum is the 200-day MA average that has been so pivotal in the recent past.

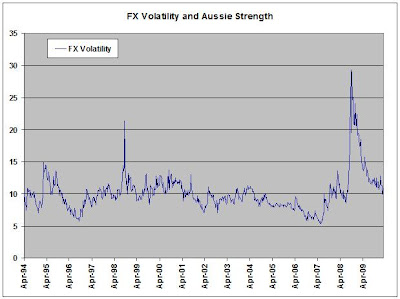

Chart: FX Volatility

This is a measure of broad FX volatility (from Deutsche Bank, which uses 1-month volatilities), which has persistently fallen since the panicky days of late 2008 and early 2009 along with the general rise in risk willingness. Last week saw an sizable uptick as there finally enough of a sell-off in equities for volatility to ruffle its feathers slightly. Looking at the bigger picture, it is easy to see that volatility has been much lower in the past and we continue to fall toward the average of the 2004-06 days, we should be projecting AUDUSD to parity and a continued heyday for EM currencies. But what is the new normal for volatility, if there is one? It would seem that expecting a repeat of the great bubble days of 2004-early 2007 when banks were leveraging themselves to the hilt and volatility only seemed to fall, fall, fall is out of the question. This will especially be true if bond yields really are ready to break out here.

This is a measure of broad FX volatility (from Deutsche Bank, which uses 1-month volatilities), which has persistently fallen since the panicky days of late 2008 and early 2009 along with the general rise in risk willingness. Last week saw an sizable uptick as there finally enough of a sell-off in equities for volatility to ruffle its feathers slightly. Looking at the bigger picture, it is easy to see that volatility has been much lower in the past and we continue to fall toward the average of the 2004-06 days, we should be projecting AUDUSD to parity and a continued heyday for EM currencies. But what is the new normal for volatility, if there is one? It would seem that expecting a repeat of the great bubble days of 2004-early 2007 when banks were leveraging themselves to the hilt and volatility only seemed to fall, fall, fall is out of the question. This will especially be true if bond yields really are ready to break out here.

Strap on your crash helmets, as we may be in for choppy trading conditions ahead for all of the reasons we have outlined today. After today's close we get another weekly ABC consumer confidence report. Then after the Thursday and Friday event risks, we have a very heavy treasury auction calendar next week. Some are pointing out the negative US 10-yr. swap spread and pondering its implications (see article here: ), so the US bond market next week will be a potentially important focus for the greenback, and certainly for the JPY.Here is the question of the day on this matter however: can you have a destabilizing US bond market and continued strong risk appetite globally? If we do see an ugly situation with funding shortfalls in the US bond market, this would see a further sharp rise in US yields and could serve to short circuit the development in ever lower volatility we showed above. And in that case, what does the market prefer to do in as the US bond market goes up in flames to a greater or less degree, sell greenbacks and buy riskier currencies? It's already been doing that hand over fist lately...any such development in the US bond market would, in other words, likely change the current market paradigm.

No comments:

Post a Comment