Over the past week, the Greeks passed the framework for an austerity package which would cut 28.4 billion Euros over the next 5 years. They also will look to sell 50 billion Euros worth of public assets including water works, ports, public owned banks and the countries gambling operations. Next on tap on Saturday is the passing of the next tranche (12 billion Euros) of fresh money to the Greece which represents the 5th installment from the $110 billion Euro package passed in May 2010.

There has been rioting in the streets, rocks thrown (reports of protesters taking hammers to the steps from around parliament - that will cost more money to repair guys!), tear gas tossed and tossed back. What do you expect when 75% of the population don’t approve and you have to work longer in life and may even have to work for a private company(with profit goals and accountability) rather in the public sector. That’s life. Greece is not supposed to be a Germany. It is simply supposed to be Greece and find it’s niche in the EU economy while keeping their budget in balance. They did not do that, so the adjustment has to be made. That adjustment will take time. Going from public to private will take time and if so, it will also take money – money from the likes of Germany, France, the other members of the EU and the IMF (and world).

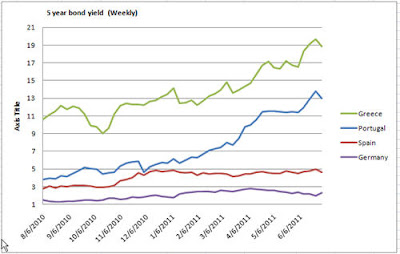

Speaking of which, the EU finance ministers are hoping to be able to put together another framework for a 2nd rescue package by July 11th. Greece would like another package like the first. The purpose is to give them the money to get them through their boorowing needs going forward, i.e. so they don’t have to source the debt auction markets. The below graph shows why (5 year note yields on select EU bonds). The yields on debt of Greek bonds have soared. Although they came down this week (to 18.82 % from 19.67% last week), borrowing in the market is prohibitive and would only increase the burden they are trying to fix. Oh my!

So that gets to the next hurdle which was in the news this week, the rollover of the current debt outstanding (or the French Plan as it is commonly being called).

The Germans want the private sector, that is the Greek bond buyers to bear some of the burden of a bailout. In laymans terms, they do not want the owners of Greek debt (ie. banks in Germany, France, etc), to simplysay “give me my money back” when the bonds mature. You see countries with debt assume (rightly or wrongly – USA take note) that the holders of that debt will rollover that debt when those bonds mature. That is not a guarantee.

In the Greek situation, some bond buyers may actually like to rollover at 18% and take their chances. Some may not be able to because the investors have restrictions on the quality of the paper/debt they can buy. With Greece’s credit rating being that of junk status those with restrictions would not be able to rollover their debt – even if they wanted to. The fact that yields are up at 18% suggest that the process of liquidation has already occurred amongst some participants. In other words, aa credit ratings dropped, those owners sold. Who did they sell to? The ECB has taken up the slack by buying that paper and increasing their balance sheet in the process (you can call it their own QE but they don’t term it that way).

Anyway, when the Greek paper/debt matures over the next three years, the members of the EU (Germany in particular) do not want to be solely responsible for taking up the slack with more rescue money. In other words, they want the banks who hold the paper still, to rollover the proceeds in new Greek paper/debt. This would share some of the burden with the private sector.

So the French (it is called the French Plan), devised a plan whereby they would ask the bond holders of maturing debt between now and 2014 to rollover their debt into a portion consisting on new 30 year bonds at 5.5% with a provision for profit sharing tied to Greek GDP. The current bonds that are held are earning coupon rates around this level.

A second portion would be voluntarily rolled into zero coupon bonds backed by the full faith and credit of a triple AAA rated entity of the EU. This would protect the bond buyers of some principal loss in case of default by Greece (since it is backed by the AAA rated entity and that entity would be responsible for payment of the principal upon default).

The goal is to rollover 50% of the maturing Greek debt into the 30 year bonds at 5.5%, 20% in the zero coupon bonds and they assume 30% of the bondholders will simply say “I would like to help, but I simply cannot rollover anything into anything Greece – let alone for 30 years”.

If that mix can happen, 70% of the Greek debt rollover would be assured over the next 3 years and the private sector would have participated (perhaps appeasing the taxpayers of the EU in the process). Greece would be free of having to tap the bond market at prevailing market rates. Phew.

The German banks approved this plan this week. I am sure (or think the French banks would approve as well). How the other bond holders fall in line, I do not know.

A caveat of this voluntary rollover is how do the credit agencies view this event. There is worry that they will consider it as a default of the bond provisions of the current bonds. The thought is bond holders are forced to accept lower than market interest rates (I guess). I look at it if it is voluntary as a maturing bond gets paid off, and the holders say “I want these new bonds now”. The new bonds are at lower rates then market, but the investors are aware of that. In essence, the Greeks (well EU) paid the bond holders their money back upon maturity. Therefore they did alter the original bonds provisions. NO default. No event.

If the credit agencies disagree and say it is a default, that is when all hell is likely to break loose.

For one, the Credit DefaultSwap (CDS) market would trigger a default event and although the implications are unclear, it is likely it will not be pretty for financial institutions. The owners of CDS who bet on a default would be happy, but it is those who bet that there would not be a default, who would be hurting. Typically, those who take the losing side on a default are the market makers who make two-way prices in the CDO’s (not the speculators). That typically means financial institutions who feel they have an obligation to be the market maker (i.e. show a 2-way price) at all times. The exposure they have could cause stress to those banks and in turn on the financial markets in general.

The second implication of a default is that the ECB would be in a quandary as far as the collateral they accept for loans. The ECB has been a source of liquidity to Greek banks who are obviously under stress. The Greek banks – in return for the liquidity from the ECB i.e. hard cash – will give the ECB Greek bonds that pays a coupon payment (as long as they are not in default).

The ECB has provisions that the paper they accept as collateral, has to be a certain investment grade before they give a loan. Well, the ECB has already changed that rule to accommodate both Greece and Ireland whose ratings bave dipped below the acceptable investment grade level. That is, they have said that they will accept Greece’s below grade debt as collateral for a loans to banks who own Greek bonds and need cash. This has already prevented a collapse of the Greek banking sector.

In the event of “default”, the ECB would now have to say in effect, “I will accept as collateral an issuer of a country that has defaulted”. How do you explain that to the markets. How do you justify that as a central bank. That would be very difficult.

As a result, although the newswires will be full of speculation on a default possibility by credit agencies, I would bet the political pressure (from the worlds central bankers) on the rating agencies will be such to not let it happen.

If the credit agencies give a default verdict anyway, they better get ready to start marking down ratings on many, many more banks, sovereign debt, etc. as French banks will be under pressure, German banks will be underpressure. UK banks which have exposure in France willl be under pressure, US banks which have exposure will be underpressure, etc, etc, etc. In other words, the “default” will in turn start a whole series of events that will be catastrophic to not just Greece but to the fabric of the global financial markets in general (buy gold). This is “the contagion” that the experts talk of.

For that reason, it should not happen (I hope it does not happen at least).

So that is what just happened and a little look as what is likely to happen. The goal (again) is to take the steps – one by one that will hopefully allow a healing. In order to do that, the EU needs to buy time and keep Greece solvent. That time will hopefully allow Greece to restructure from a socialist economy to a more capitalist economy focused on areas that they as a nation can build. They will never be Germany. Can they find their own niche? They willl have to, but it will have to be within their means. They simply do not and will not have the full support of the capital markets to tap at will. It will take time and until then, the EU will likely continue to support the progression.

For the forex markets, the EURUSD has the potential to get a pop on the back of credit agencies saying the “French Plan is ok. There will not be a default” (I don’t know when that will happen) Meanwhile, the ECB is largely expected to raise rates this week and the US has their unemployment numbers which are expected to be weakish (on Friday). This should favor the EURUSD but who knows what is priced in already.

The other key event will be the US debt crisis which has less than 3 weeks to sort itself out (July 22nd would likely be the drop dead date for an agreement to be made to have enough time to vote on it by August 2nd). If progress is made – and the Greek events unfolding this week should have lit a fire under lawmakers to get going – that could help the dollar. If they continue to fight and not make progress, the dollar could be in for a rough ride.

I do expect that the US does not have a choice but to get something done. The implications of the US defaulting on August 3rd or having their credit rating lowered would be devastating (Think Greece times a factor). Therefore, not having an agreement is not an option. An agreement will happen.

That does not mean that Washington, in their inevitable style, will not fumble along (I wish they did not). However, on or around July 22nd and then again on August 2nd, you can expect the bi-partisan photo shoots with arms joined hand in hand raised up, big smiles on their faces in fromt of the backdrop of neatly folded flags (why they don’t just let the flags hang naturally instead of having them starched and folded as if they were an oragami figurine- makes me cringe with embarrassment).

They will then chatter about how hard they worked and what a monumental day it is that a debt ceiling (since when should be proud of raising a debt ceiling) can now be raised – not simply by signing on a line, but with real progress on working toward a balanced budget. Horray! More debt. Instead they should humbly go back to work, like the rest of us, and leave the self promotion out of the news, and realize that they are simply buying time – just like the Greeks.

No comments:

Post a Comment