Not only did the Troika conference call yesterday not result in any

concrete initiatives, but not long afterwards S&P, the ratings

agency, went ahead and downgraded Italy in line with what it had earlier

indicated was likely to occur. The calendar does have a few interesting

numbers, but the Eurozone's struggles will be the agenda today before

we gear up for the FOMC tomorrow.

Italy downgraded: One of the three big rating

companies, S&P, went ahead and lowered Italy's sovereign debt rating

by one notch to A from A+ previously and also slapped a negative

outlook on the sovereign. The move surprised the markets with the EURUSD

giving back all of the hardfought gains yesterday evening, but S&P

actually had warned that such a move might take place stating in July

that there is a "one-in-three likelihood that the ratings could be lowered within the next"

two years. The rating agency expects Italy's economic activity wlil

grow 0.7 percent annually over the coming three years which seems very

low only until you consider that 1) Italy's GDP has only grown 0.2

percent annually from 2001 to 2010 and 2) that the country faces adverse

effects from its coming austerity programme, which will further inhibit

growth... Not exactly the perfect starting point of an attempt to lower

the debt-to-GDP ratio of 119 percent and public deficit-to-GDP of 4.6

percent (December 2010 numbers).

Greece-Troika conference call proves fruitless: Despite the insistence of Greek Finance Minister Venizelos that the conference was "productive" the end result was weak by any standards with an agreement to schedule another conference call today in which further talks about the data will take place. The announcement afterwards said that a deal is close by, only to be followed up by the statement that some work is still needed to quantify measures. With the markets pricing in a near perfect probability of default let us see how long the charade will continue before the inevitable happens and Greece defaults, in an orderly or inorderly manner.

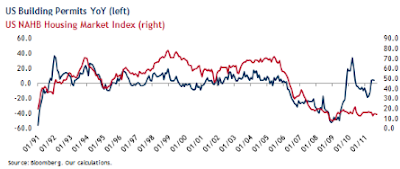

Building permits to decline in the U.S.: Yesterday's weak NAHB Housing Market Index printing 14 in September down from 15 last month did nothing to change the dismal outlook for the U.S. housing market. Today's Housing Starts and Building Permits report is expected to show declines in both to 590,000. The latter is part of the Conference Board's Leading Indicators Index.

(Note the disruptions in permits in 2010 caused by the First Time Homebuyer Tax Credit programme)Greece-Troika conference call proves fruitless: Despite the insistence of Greek Finance Minister Venizelos that the conference was "productive" the end result was weak by any standards with an agreement to schedule another conference call today in which further talks about the data will take place. The announcement afterwards said that a deal is close by, only to be followed up by the statement that some work is still needed to quantify measures. With the markets pricing in a near perfect probability of default let us see how long the charade will continue before the inevitable happens and Greece defaults, in an orderly or inorderly manner.

Building permits to decline in the U.S.: Yesterday's weak NAHB Housing Market Index printing 14 in September down from 15 last month did nothing to change the dismal outlook for the U.S. housing market. Today's Housing Starts and Building Permits report is expected to show declines in both to 590,000. The latter is part of the Conference Board's Leading Indicators Index.

FOMC meeting commences today: The expanded two-day FOMC meeting commences today at 13:00 GMT with the (unchanged) rate decision tomorrow at 18:15. Will the committee announce QE3, Operation Twist or a third monetary policy tool? We will have much more on this in tomorrow's piece.

No comments:

Post a Comment